2026 Market Outlook

Focusing on structural and institutional changes.

Executive Summary

Crypto markets are undergoing a clear structural transition as we head into 2026. What was once primarily a retail-driven, speculative asset class is increasingly defined by institutional participation, regulatory normalization, and real-world financial utility.

Across on-chain activity, market structure signals, and settlement behavior, one theme consistently stood out in 717 research:

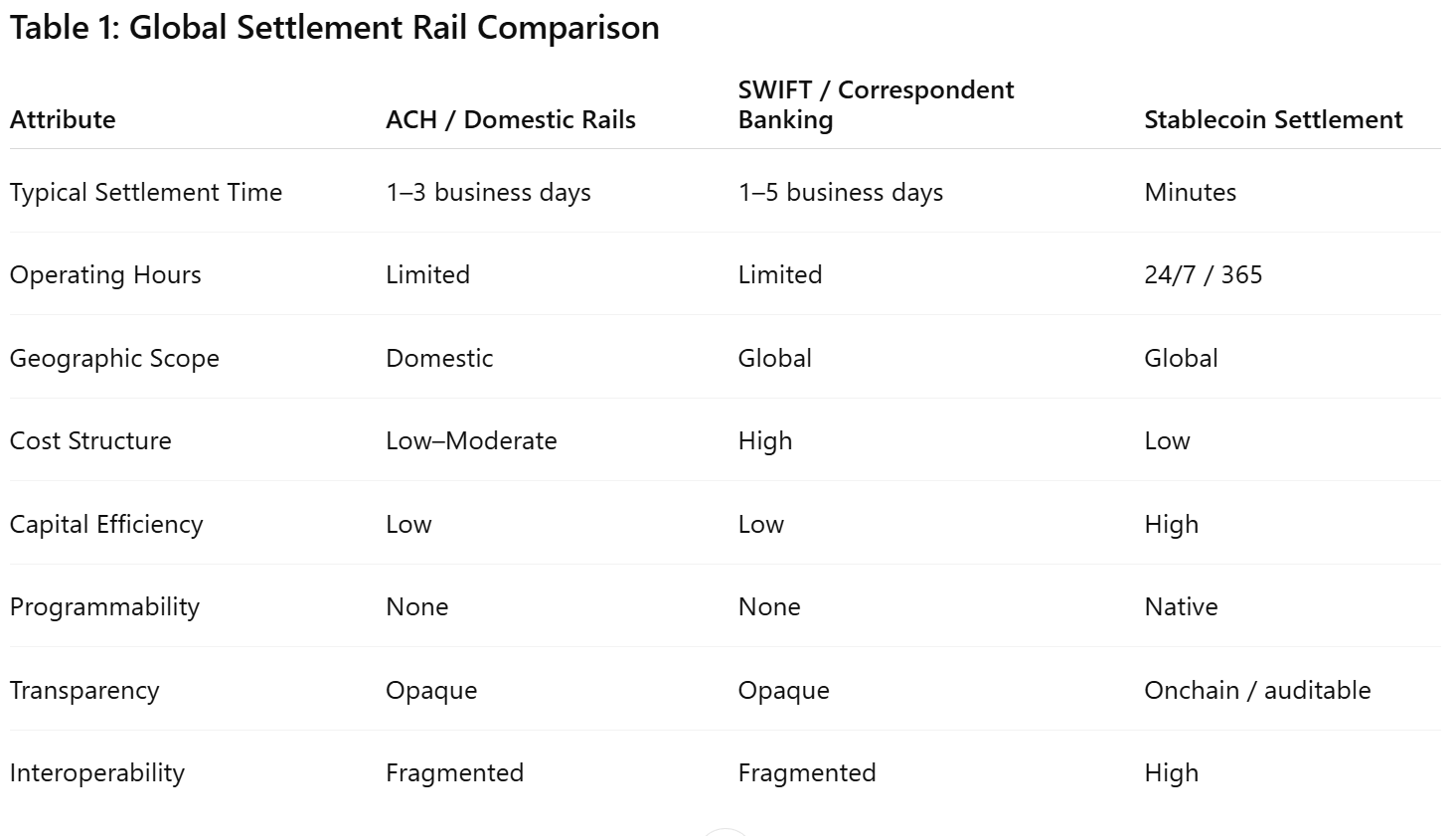

Dollar-denominated stablecoins are emerging as the core settlement and liquidity layer of the digital finance ecosystem.

As of 2025, dollar-denominated stablecoins regularly settle $8-12 trillion in annual on-chain transaction volume, rivaling or exceeding the annual settlement value of several major legacy payment rails, despite representing a fraction of global banking infrastructure.

Key conclusions from our analysis:

- Crypto adoption is shifting from asset speculation toward financial infrastructure.

- Stablecoin settlement activity is growing more consistently than price-sensitive crypto token markets.

- Institutional capital is reshaping liquidity, volatility, and execution requirements.

- TradFi players beginning to expand Tokenization and decentralized finance (DeFi) settlement options.

- Stablecoin-centric infrastructure benefits across market regimes, not just bull cycles.

For 717 Capital, these dynamics reinforce the strategic importance of stablecoin settlement, liquidity management, and institutional execution services as foundational components of the digital asset economy. In 2026, we plan to expand on 717ai treasury management capabilities (ability to capture overnight yields) after successfully realizing $71m in institutional volume execution in 2025.

I. Market Participation Shift

Historically, crypto markets were dominated by reflexive boom-and-bust 4-year cycles driven by retail participation and price momentum. Entering 2026, that paradigm is shifting.

The shift is observable via:

- Persistent growth in transactional activity, even during periods of muted/flat price performance.

- Expansion of crypto usage into payments, treasury operations, and collateral management.

- Rising demand for regulated custody, settlement, and execution infrastructure.

Unlike prior cycles, where activity collapsed during drawdowns, stablecoin-denominated activity has remained resilient. During periods of flat or declining spot prices in 2024-2025, settlement desks across the industry continued to observe consistent stablecoin transfer volumes ties to treasury rebalancing, counterparty netting, and cross-border liquidity movements - even as speculative spot trading volumes declined materially.

Between 2022 and 2024, total crypto market capitalization declined by more than 60%, yet aggregate stablecoin supply remained within a 15% range for most of the period, while transaction counts and settlement volumes remained elevated. This divergence highlights that stablecoin usage increasingly reflects transactional demand rather than speculative positioning.

Interpretation:

Crypto's long-term value proposition is increasingly defined by its ability to move, settle, and manage dollars efficiently, not solely by asset price appreciation.

Implications for 717:

- Positions stablecoin settlement as a structural, non-speculative revenue vertical.

- Reinforces an infrastructure-first strategy over directional OTC trading services.

- Aligns 717 with long-term adioption rather than cyclical market timing.

II. Increasing Stablecoin Usage & Adoption

Dollar-denominated stablecoins have become the dominant transactional unit across crypto markets and are increasingly used as digital cash equivalents.

Key drivers of adoption include:

- Speed - near instant settlement versus multi-day legacy rails

- Cost - lower fees and reduced reconciliation overhead

- Programmability - automated, conditional settlement logic

- Interoperability - seamless movement across platforms and jurisdictions

On several major blockchains such as Ethereum and Solana, stablecoins represent 60-80% of transaction value, even when they account for a minority of transactions by count. Additionally, large OTC desks and CEXs report that a majority of institutional crypto trades are quoted and settled in stablecoins, not fiat. 717 experiences this in our own trade settlement operations and it mirrors traditional FX and fixed-income markets, where cash settlement dominates notional turnover despite limited balance-sheet exposure.

Over the past several years, stablecoin supply and settlement velocity have expanded steadily, reflecting growing users across:

- Cross-border B2B payments

- OTC and institutional trade settlement

- Treasury liquidity management

- DeFi collateral and credit markets

Stablecoins now function as the base layer of digital financial activity, analogous to how cash underpins traditional financial systems.

.png)

Implications for 717:

- Direct exposure to increasing settlement volume and frequency

- Opportunity to monetize execution quality, liquidity access, and reliability

- Reinforces the importance of cross-chain and cross-venue settlement optimization (99% of 717 settlements)

Key Insight: Stablecoin settlement combines speed, capital efficiency, and programmability in a way legacy rails cannot replicate without structural redesign.

III. Institutional Capital & Market Structure

Institutional participation has reached a scale where it increasingly shapes crypto market structure.

Observable indicators include:

- Growth in regulated investment vehicles and custody balances

- Expansion of derivatives markets and structured hedging activity

- Increased emphasis on compliance, reporting, and counterparty risk

By 2025, regulated investment vehicles, custodians, and derivatives venues collectively held hundreds of billions of dollars in digital assets under custody, while open interest in regulated crypto derivatives regularly exceeded $20-30 billion during normal market conditions. Importantly, institutional participation increased with a reduction in volatility, with realized volatility in major crypto assets declining materially compared to prior retail-dominated cycles.

Institutional capital introduces:

- Longer-duration balance sheet deployment

- Lower tolerance for operational and settlement risk

- Demand for predictable liquidity and execution outcomes

As a result, value accrues less to speculative positioning and more to infrastructure that supports reliable settlement and risk management.

Implications for 717:

- Increases demand for institutional-grade settlement desks

- Favors firms with compliance-first, risk-aware infrastructure

- Shifts value creation towards execution and balance-sheet efficiency

IV. TradFi Players Expand Tokenization and DeFi Options

Tokenization and DeFi infrastructure are no longer experimental concepts confined to crypto-native firms. Large, systemically important banks are actively deploying tokenized assets, on-chain settlement mechanisms, and blockchain-based collateral systems within regulated and permissioned environments. These initiatives are not driven by ideological alignment with crypto, but by efficiency gains in settlement, collateral mobility, and treasury management optimization.

Observed Institutional Developments:

Several major banks have progressed beyond pilots into live or production-adjacent implementations:

- JPMorgan has deployed JPM Coin alongside tokenized cash and securities settlement infrastructure through its on-chain payments and asset servicing initiatives.

- Standard Chartered has heavily invested in digital asset infrastructure such as Zodia Markets OTC desk.

- UBS has launched tokenized investment products for institutional and HNWI

- Goldman Sachs has developed and deployed tokenization infrastructure for bond issuance

These bank programs are not theoretical. TradFi institutions have already issued tokenized bonds exceeding $1 billion in aggregate notional value, and reduced settlement cycles from T + 2 to near real-time. In each case, the limiting factor has not been asset tokenization, but the availability of stable, cash-like stablecoin liquidity and infrastructure capable of supporting real-time settlements. In multiple implementations, institutions have cited intraday liquidity availability and cash-leg settlement as the primary constraints, reinforcing the importance of stable-value settlement infrastructure.

Implications for 717:

- Clear path for asset origination revenue integration

- Regulatory-friendly crypto banking environment

- Direct banking support increases settlement flexibility

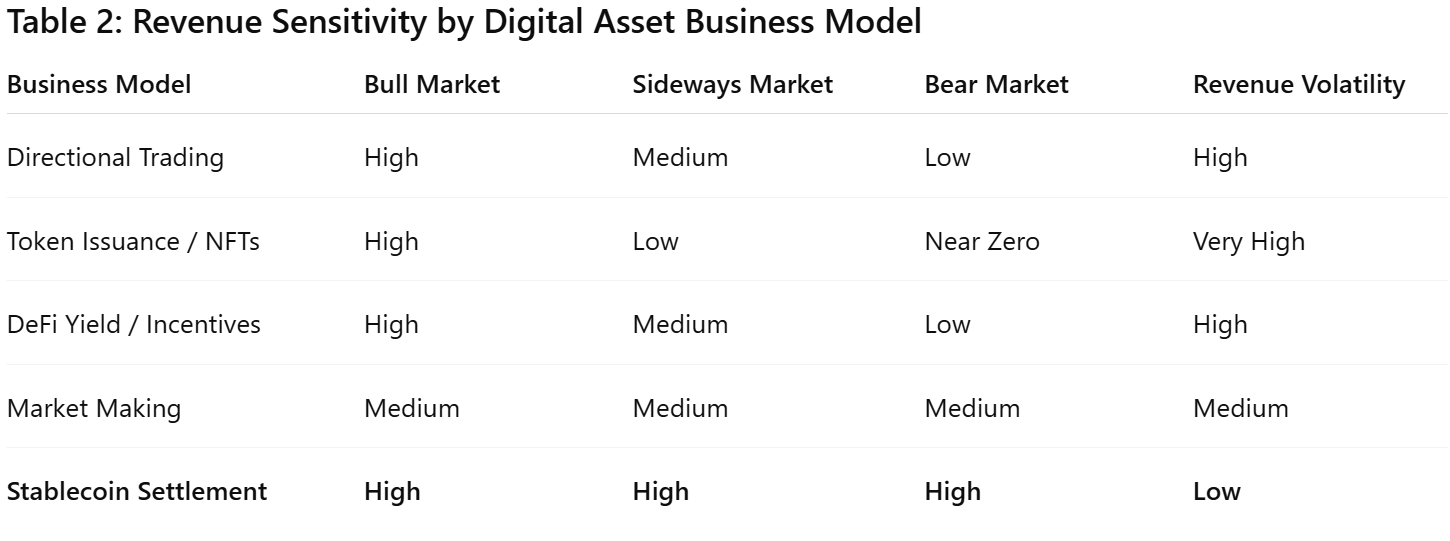

V. Stablecoin Activity Across Market Cycles

Unlike speculative crypto assets, stablecoin settlement activity exhibits low correlation to price cycles.

Observed characteristics include:

- Persistent volumes during market drawdowns

- Increased usage during volatility events (hedging, repositioning)

- Continued growth amid macro uncertainty

During periods of market stress, including multiple volatility events between 2022-2024, stablecoin transfer volumes increased sharply even as spot trading volumes declined. In several episodes, daily stablecoin settlement volumes exceeded $50-100 billion, reflecting capital flight, hedging, and liquidity repositioning rather than speculative risk-taking. This behavior closely resembles cash usage patterns in traditional markets during stress events, where transaction demand rises as risk assets reprice.

.png)

This positions stablecoin infrastructure as non-cyclical, risk-mitigating, and liquidity-preserving.

Implications for 717:

- Revenue durability independent of bull and bear markets

- Strategic relevance during stress and deleveraging events

- Reinforces settlement as a defensive, core business line

Key Insight: Stablecoin settlements benefit from volume, velocity, and necessity, not price appreciation.

VI. Strategic Outlook for 717

The convergence of institutional adoption, regulatory normalization, and infrastructure growth positions stablecoin settlement as a core financial primitive of the digital asset economy. 717's strategic advantage lies in operating where transaction volume is persistent, scalable, and institutionally relevant.

Key focus areas include:

- Settlement efficiency and liquidity access

- Institutional execution and risk management

- Cross-chain and cross-border settlement workflows

- Treasury Management Capabilities

As stablecoin settlement continues to institutionalize, competitive advantages will accrue to platforms capable of combining compliance, treasury management, and execution reliability - rather than pure market access or leverage. 717 Capital's experience executing significant settlement volume in 2025 provides early validation of this model.

Conclusion

2026 represents a maturation phase for crypto markets:

- From speculative narratives to infrastructure-driven adoption

- From retail cycles to institutional integration

- From isolated crypto activity to embedded financial systems

Stablecoins sit at the center of this transition.

For 717 the opportunity is clear: build, optimize, and scale the settlement infrastructure that underpins the next phase of traditional finance.

Methodology Note: Data references in this report draw from issuer disclosures, public blockchain explorer aggregates, regulated market statistics, and anonymized settlement-desk observations. Numerical values are presented to illustrate structural scale and directional trends rather than precise measurement. Forward-looking projections reflect expected continuation of observed institutional adoption patterns.

What is $WIRE?

The $WIRE token is a utility asset integrated with 717ai Agent settlement services and supported by the existing core business revenue of 717 Capital.